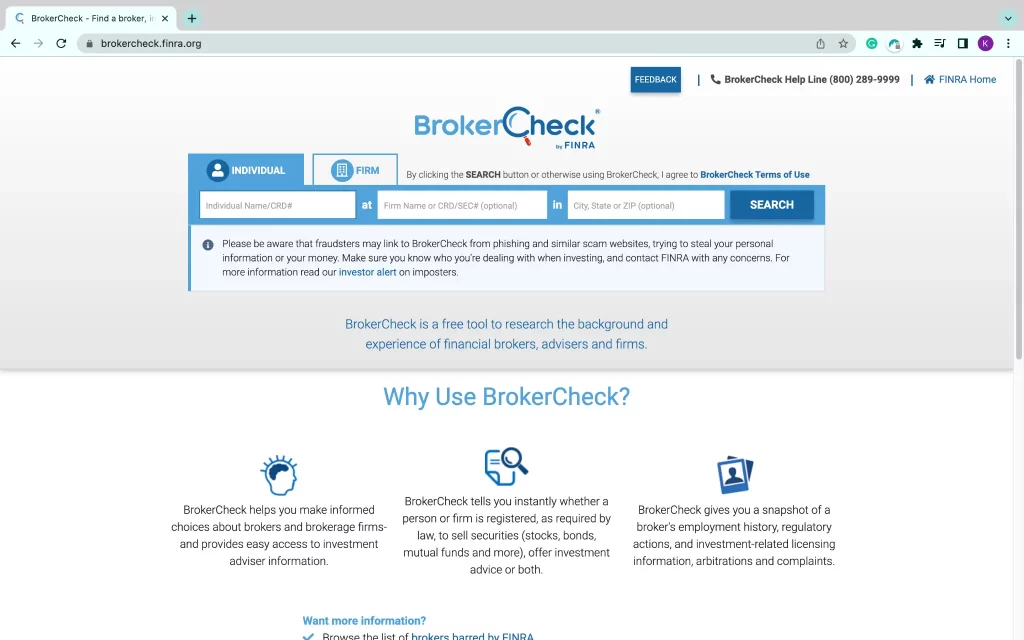

What’s BrokerCheck?

BrokerCheck is a device any investor can use to analysis a monetary skilled or agency. This device permits people to finish an intensive background test on monetary professionals like brokers, brokerage companies, monetary advisors, funding advisors, advising companies, and so on. The detailed info offered by way of the BrokerCheck device consists of their employment historical past, certifications, licenses, and energetic or previous violations inside the final ten years so that you could make an knowledgeable resolution whereas hiring an advisor.

You should utilize the Brokercheck device on the FINRA web site. The Monetary Business Regulatory Authority (FINRA) is a non-public company that regulates companies inside its system and web site. The Securities and Trade Fee’s (SEC) web site can also be helpful in gathering particulars on funding advisors and companies.

What Info Does FINRA BrokerCheck Present?

BrokerCheck supplies the next:

- Transient Overview: A quick overview of an advisor or dealer’s employment info and credentials.

- {Qualifications}: The advisor or dealer’s {qualifications} together with licensing, exams handed, and the place the monetary skilled is registered.

- Employment Historical past: Mentions the place the dealer or advisor at present works and supplies data relating to employment historical past for the earlier ten years, together with any work expertise outdoors the brokerage business.

- Disclosure Notices: Info relating to whether or not the monetary skilled obtained disciplinary actions, shopper complaints, or if any felony felonies have been dedicated or charged. A few of this info can relate to ongoing authorized proceedings or unresolved or unproven allegations. As well as, lately submitted feedback on these points offered by the dealer or advisor may be included.

Use the step-by-step information under to start utilizing BrokerCheck to judge monetary professionals:

Steps-by-Step Information To Utilizing BrokerCheck

1. Go to the FINRA BrokerCheck Web site:

To start accessing a BrokerCheck report for a person or agency, go to the BrokerCheck web site. Right here you’ll enter details about the monetary skilled or agency.

https://brokercheck.finra.org/

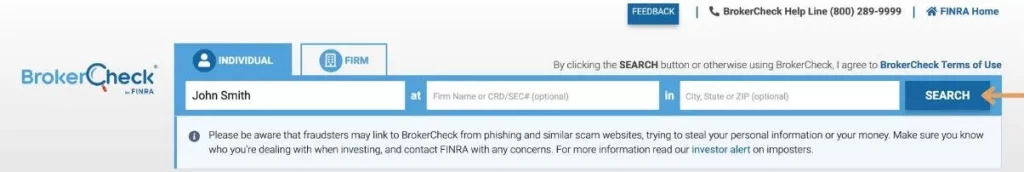

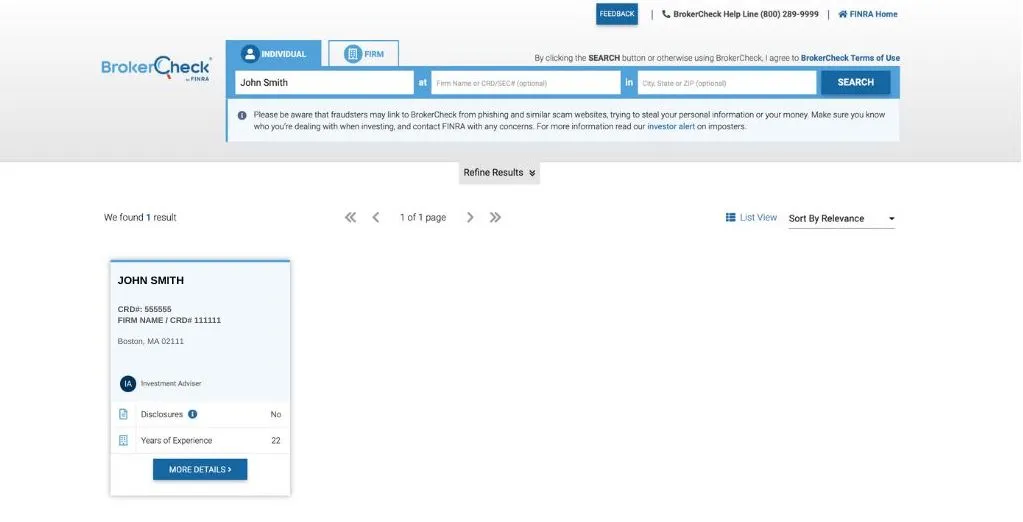

2. Enter the Dealer’s Info

As soon as on the BrokerCheck web site, insert the advisor identify, agency identify, or Central Registration Depository (CRD) quantity, which you’ll find on the advisor’s profile on the WiserAdvisor listing. After inputting the knowledge, click on SEARCH.

3. Overview The Report

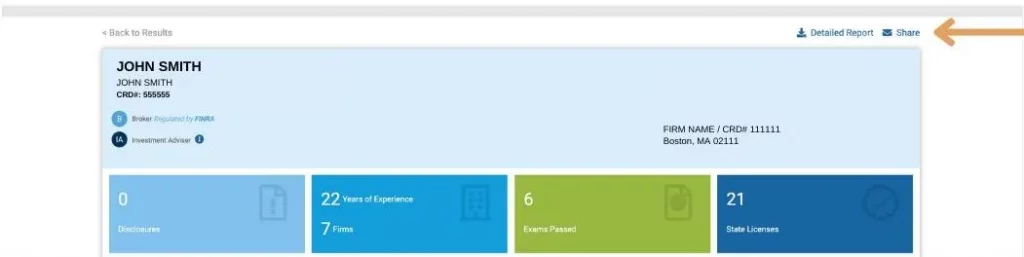

On the primary web page, you’ll obtain a preview of the dealer/advisor/agency’s report, together with their identify, agency identify, disclosure info, years of expertise, and extra.

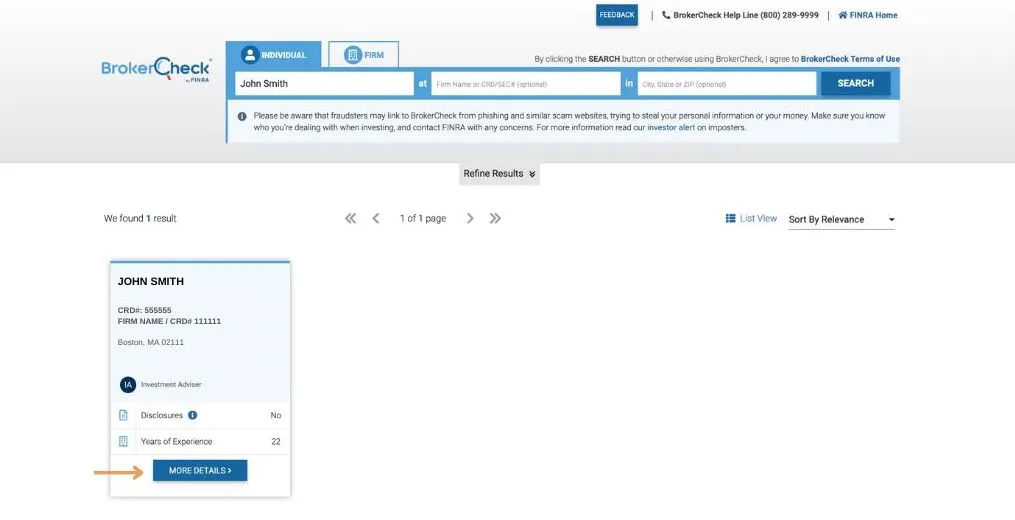

3a. To obtain additional detailed info in your advisor, choose the “Extra Particulars” button to generate a report abstract.

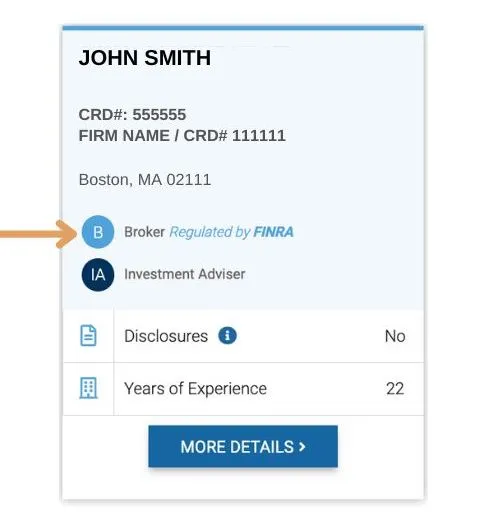

3b. In case your advisor/agency is a dealer, you can see detailed info relating to your advisor by way of BrokerCheck. You’ll know whether or not the skilled/agency you looked for is a dealer if “Dealer Regulated by FINRA” is highlighted in darkish blue as proven within the picture under.

3c. In case your advisor/agency just isn’t a dealer, you can be redirected from the BrokerCheck web site to the SEC web site: https://adviserinfo.sec.gov/

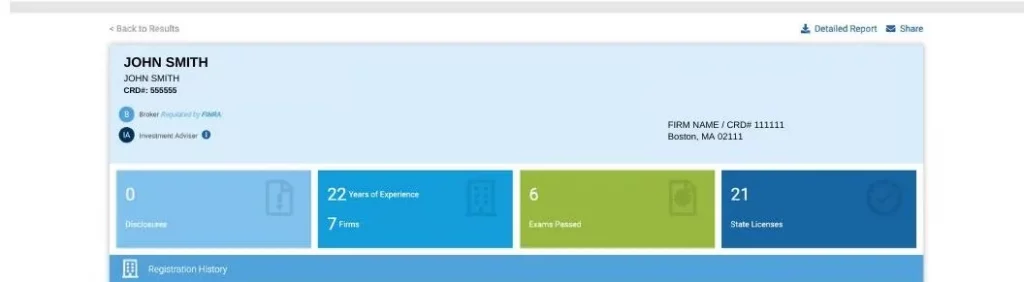

4. View Report Abstract

On the subsequent web page, you can see an in depth abstract of the monetary skilled/agency’s BrokerCheck report. This abstract will embrace info comparable to employment historical past, disclosures, years of expertise, exams handed, examination outcomes, licenses, and registration historical past.

5. Obtain or Share Report

After reviewing the summarized info, for those who want to obtain or share your monetary skilled/agency’s full detailed report, click on the corresponding hyperlinks within the high proper nook.

Discovering the best monetary advisor or agency is crucial for the success of your future monetary plans. So as so that you can attain your monetary targets, it is suggested that you just attempt to rent an advisor or agency that may work in your greatest curiosity and be reliable. Due to this fact, it’s important so that you can spend time evaluating and researching advisors with a purpose to get sense of their credibility and efficiency.

Click on right here to learn extra about BrokerCheck.